Trends in Aseptic Bag-in-Box Market (2025-2035)

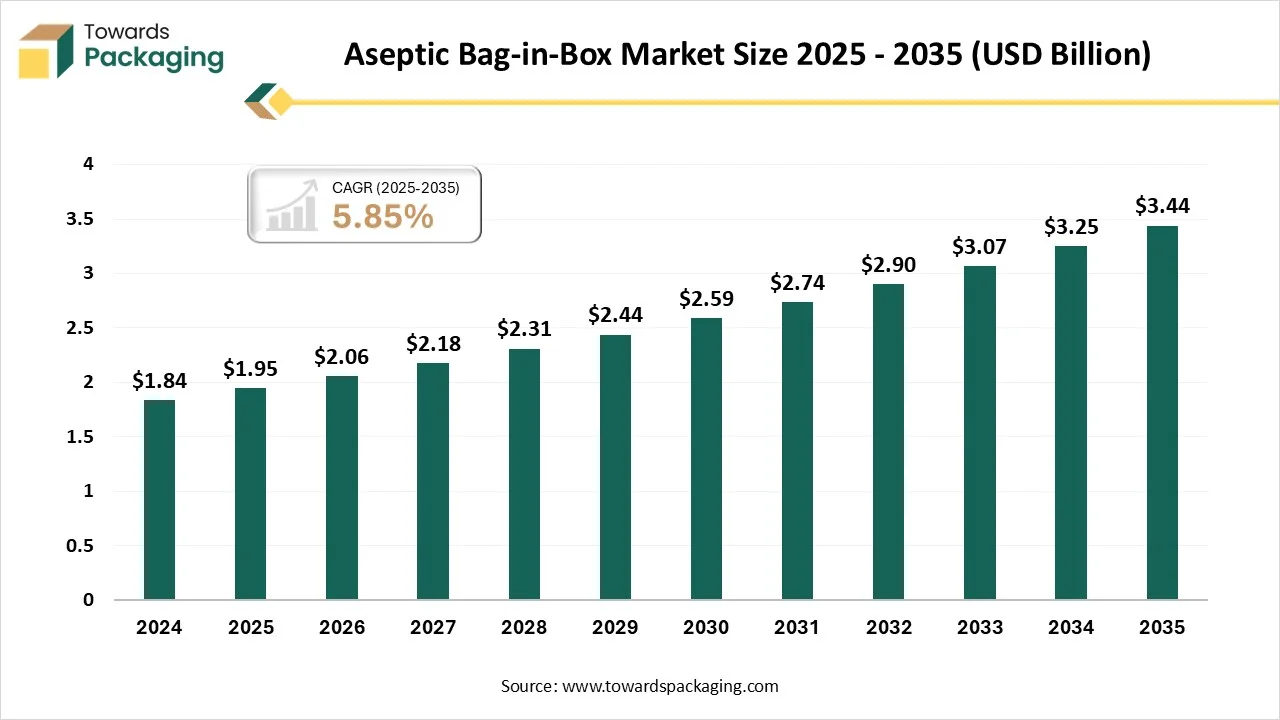

Based on insights from Towards Packaging, the global aseptic bag-in-box market will likely grow from USD 1.95 billion in 2025 to around USD 3.44 billion by 2034, expanding at a CAGR of 5.85% over the 2025-2034 period.

Ottawa, Dec. 02, 2025 (GLOBE NEWSWIRE) -- The global aseptic bag-in-box market stood at USD 1.95 billion in 2025 and is projected to reach USD 3.44 billion by 2034, according to a study published by Towards Packaging, a sister firm of Precedence Research. The market is significant due to its role in enhancing food safety and decreasing waste by extending shelf life without refrigeration or preservatives. It also provides sustainability benefits and consumer convenience, along with cost efficiencies for transportation and storage.

Request Research Report Built Around Your Goals: sales@towardspackaging.com

What is Meant by Aseptic Bag-in-Box?

Aseptic bag-in-box is considered a packaging system that uses a sealed, multi-layer plastic bag inside a rigid outer box to prevent liquid products from contamination. The process involves sterilizing both the product along the packaging separately before filling in a sterile environment, which permits products to be stored at room temperature and even extends their shelf life without preservatives. The main driving factors for the aseptic bag-in-box market are the increasing need for safe, shelf-stable, and also preservative-free products and a rising emphasis on sustainable, along with cost-effective packaging solutions.

Private Industry Investments in Aseptic Bag-in-Box:

- SIG Group's expansion in India: SIG is opening its first aseptic carton plant in India with a substantial EUR 90 million investment, specifically targeting the growing demand for aseptic packaging in the local dairy and beverage markets.

- UFlex's new facility in Egypt: UFlex is investing an estimated $126-130 million to build an aseptic packaging plant in Egypt with an annual capacity of 12 billion packs to serve markets across Egypt, Europe, and the Middle East.

- Amcor's acquisition of Bemis Company: Amcor completed a major merger with Bemis to become a global leader in consumer packaging, a strategic move that expanded its material science capabilities and product offerings, including aseptic solutions.

- SIG's sustainable material innovation: SIG unveiled an aluminum-free, full-barrier material for aseptic cartons which significantly reduces the carbon footprint while maintaining a 12-month shelf life, representing an investment in sustainable technology.

-

Baldwin Richardson Foods (BRF) acquisition: BRF, a leading custom ingredient solutions provider, acquired Pennsauken Packing Company to enhance its aseptic beverage manufacturing capabilities with an additional state-of-the-art facility.

Get All the Details in Our Solutions - Access Report Sample: https://www.towardspackaging.com/download-sample/5851

What are the Latest Trends in the Aseptic Bag-in-Box Market?

Growing Adoption of Bag-in-Box for E-Commerce

This is driven by the combination of its cost-effectiveness, sustainability, and suitability for direct-to-consumer shipping. It is an eco-friendly alternative that decreases plastic use and is lightweight, which lowers transportation expenses and carbon emissions, appealing to both businesses and also environmentally conscious users who shop online. The growth of online shopping, mainly among younger generations concerned with sustainability, fuels the need for e-commerce packaging solutions that meet these criteria.

What Potentiates the Growth of the Aseptic Bag-in-Box Industry?

Rising Consumer Demand for Preservative-Free & Natural Products

Aseptic processing includes sterilizing both the product and the packaging separately, then engaging them in a sterile environment. This process destroys harmful bacteria along with microorganisms, guaranteeing product safety and stability for months at ambient temperatures without the demand for chemical preservatives, which many users are actively avoiding. The rapid heating along with the cooling process used in aseptic technology reduces the degradation of sensitive ingredients, colors, flavors, textures, and nutritional values which can occur with traditional canning or retort methods.

Regional Analysis

Who is the Leader in the Aseptic Bag-in-Box Market?

Asia Pacific leads the market because of a confluence of factors, which include rapid urbanization, rising disposable incomes, and even changing consumer lifestyles that drive the need for packaged food and beverages. The growing popularity of packaged beverages, including flavored milk, juices, and other natural variants, has remarkably boosted the market. The large and rising dairy industry in countries such as India has also led significantly to the requirement for aseptic packaging.

China Aseptic Bag-in-Box Market Trends

Key trends in China's market include a strong need for long-life, shelf-stable beverages and food, boosted by consumer income and even urbanization. The market is also benefiting from the government's aim on food safety and sustainability, contributing to increased adoption of aseptic packaging and even a shift towards eco-friendly materials such as recycled and biodegradable alternatives. Furthermore, the industry is seeing expansion in non-food applications and significant investment in automation to enhance efficiency and reduce defects.

How is the Opportunistic Rise of North America in the Aseptic Bag-in-Box Industry?

North America's position in the market is best described as a steadily rising, mature market presenting significant opportunities boosted by the need for sustainable convenience and the demand to cut cold-chain logistics expenses. The growth in consumer awareness and even preference for eco-friendly products, along with convenient packaging solutions, is a major driver.

Aseptic bag-in-box packaging works with these values, providing lightweight, usually paperboard-based alternatives that reduce waste and transport impact. Innovations such as more eco-friendly materials, enhanced sealing technologies, and AI-enhanced quality monitoring are making aseptic solutions more attractive to producers and consumers.

U.S. Aseptic Bag-in-Box Market Trends

The U.S. market is driven by strong expansion in the food and beverage sector, mainly for wine and juice, and even a major shift toward sustainable and cost-effective packaging. Key trends include raised adoption for non-food applications such as household and industrial liquids, technological advancements like new barrier films and even biodegradable materials, and a focus on convenience and decreased environmental impact via lighter packaging.

Canada Market Trends

Canada's market is growing due to the need for sustainable and even safe packaging, mainly from the food, beverage, and pharmaceutical sectors. Key trends include rising automation and digitalization, a target on eco-friendly materials such as recyclable and plant-based plastics, and the growth of packaging across numerous sizes and applications beyond traditional products such as wine and juice.

More Insights of Towards Packaging:

- Asia Pacific Food Packaging Market Growth, Key Segments, and Regional Dynamics with Manufacturers and Suppliers Data

- North America Pharmaceutical Packaging Market Growth, Key Segments, and Regional Dynamics with Manufacturers and Suppliers Data

- Stick Packaging Market Size, Segments, Companies, Competitive Analysis, Value Chain & Trade Analysis 2025-2034

- Dairy Product Packaging Market Size, Segments, Share and Companies (2025-34)

- Baby Food Packaging Market Size, Share, Trends, Segments, and Regional Insights (NA, EU, APAC, LA, MEA)

- North America Automotive Thermoformed Plastic Parts Packaging Market Growth, Key Segments and Regional Dynamics

- Europe Glass Prefilled Syringes And Glass Vials Packaging Equipment Market Growth, Key Segments, and Suppliers Data

- Reusable Packaging Market Size, Segments, Regional Data (NA/EU/APAC/LA/MEA), Companies, Competitive Analysis, Value Chain & Trade Analysis 2025-2034

- Recyclable Packaging Market Size, Segmentation, and Competitive Landscape Analysis

- Tube Packaging Market Size, Segmentation, Regional Insights, and Competitive Dynamics

- Non-Corrugated Boxes Market Size, Segments, Companies, Competitive Analysis, Value Chain & Trade Analysis 2025-2034

- Europe Transfer Molded Pulp Packaging Market Size, Share, Trends, Segments, and Regional Insights (NA, EU, APAC, LA, MEA)

- North America Post-Consumer Recycled Plastics Food Packaging Market Growth, Key Segments, and Suppliers Data

- Plastic Compounding Market Size, Segments, Regional Data (NA/EU/APAC/LA/MEA), Companies, Competitive Analysis, Value Chain & Trade Analysis 2025-2034

-

Airless Packaging Market Size, Segments, Regional Data (NA/EU/APAC/LA/MEA), Companies, Competitive Analysis, Value Chain & Trade Analysis 2025-2034

Segment Outlook

Capacity Insights

Why did the 20–200 Liters Segment Dominate the Aseptic Bag-in-Box Market in 2024?

Due to its ideal fit for industrial and even commercial bulk liquid handling, it provides cost efficiency, space savings, and ease of transport compared to conventional drums and intermediate bulk containers (IBCs). This capacity range is important for large-scale applications in food processing, cleaning supplies, chemical transport, and the pharmaceutical industry. Producers are investing in new films, coatings, and even closures to enhance performance and also meet evolving needs. Innovations in areas such as aseptic filling permit the preservation of high-value products without refrigeration.

The 5–20 liters segment is the fastest-growing in the market during the forecast period.

Due to its versatility for large-scale commercial usage in food service, catering, and even institutional settings. This capacity offers an optimal balance between handling ease and even storage efficiency, providing a cost-effective way to package and even dispense products such as beverages, oils, and also condiments for businesses such as quick-service restaurants and even hospitality venues. For a few commercial applications, a 5–20-liter bag-in-box is more cost-effective for storing and even dispensing bulk liquids than using smaller, individual packages or rigid containers.

Material Type Insights

Why did the Plastic Films Segment dominate the Aseptic Bag-in-Box Market in 2024?

Due to its cost-effectiveness, flexibility, lightweight design, and durability. Plastic is cheaper to produce and transport than materials such as glass or metal, and its flexibility decreases breakage during handling. Developments in plastic barrier properties and even recyclability are thus solidifying its position as the dominant material for aseptic packaging applications across numerous sectors such as food, beverage, and pharmaceuticals. While historically a concern, ongoing innovation is creating plastic films more sustainable via the development of recyclable films, mono-material structures, along bio-coatings.

The multilayer barrier films segment is the fastest-growing in the market during the forecast period.

These films offer superior protection against moisture, oxygen, and contaminants, which extends product shelf life and even maintains freshness for beverages, food, along pharmaceuticals. Advances in technology, rising need for products in e-commerce and even modern retail, and expansion in the pharmaceutical sector are also major drivers of this segment's rapid growth.

By protecting against oxygen and even moisture, these films assist in maintaining the freshness and integrity of products, mainly for beverages such as wine, juice, and also water, which is vital for both consumer convenience and even reduced waste.

Bag Type Insights

Why did the With Spout Segment Dominate the Aseptic Bag-in-Box Market in 2024?

Spouts permit for controlled dispensing of liquids such as juices, sauces, and even wine, which is convenient for consumers along ideal for commercial use. This kind of packaging is favored in both household as well as institutional settings because of its ability to maintain product freshness, decrease waste via precise portion control, and even facilitate efficient pouring. In commercial along institutional settings, such as restaurants and cafeterias, spouts enable the efficient, controlled, and even hygienic dispensing of large volumes of liquid.

The without spout segment is the fastest-growing in the market during the forecast period.

Due to the push for greater sustainability, mainly through the elimination of plastic spouts. This expansion is also driven by advancements in packaging materials that offer a better barrier and are more lightweight, and by the rising demand for shelf-stable products such as plant-based beverages and also wine, which can be filled aseptically without demanding a spout. Newer packaging materials, like those made from paperboard with a polyolefin blend barrier, provide excellent protection against oxygen and even light without needing aluminum or plastic.

Filling Technology Insights

Why did the Aseptic Filling Segment Dominate the Aseptic Bag-in-Box Market in 2024?

Due to its ability to stretch product shelf life without preservatives, manage product quality, and even ensure safety from contamination. This is driven by rising consumer need for convenience foods and beverages, the demand for safe and sterile packaging in the pharmaceutical sector, and the rising preference for sustainable packaging options such as bag-in-box. Bag-in-box packaging is usually made from renewable resources and even uses less plastic than other alternatives, appealing to both producers and consumers looking for sustainable solutions.

End-Use Industry Insights

Why did the Food & Beverage Processing Segment Dominate the Aseptic Bag-in-Box Market in 2024?

Due to its ability to extend shelf life, improve product safety, and reduce expenses. This packaging method is ideal for preserving the quality of products like juices, wine, sauces, and also milk, eliminating the demand for refrigeration and even artificial preservatives while maintaining their color, taste, and nutrients. The lack of demand for refrigerated transport and storage significantly lowers logistics and energy expenses for both manufacturers and consumers.

The wineries & alcoholic beverage companies segment is the fastest-growing in the market during the forecast period.

This is because of a combination of factors, including extended shelf life, sustainability, convenience, and also e-commerce growth. The aseptic bag-in-box format offers superior protection against oxygen and light, and even extends the shelf life of beverages, and meets consumer need for eco-friendly packaging alternatives that are lightweight and also durable for shipping. Aseptic bag-in-box technology protects oxygen and light from degrading the product, which is vital for maintaining the quality and even flavor of beverages such as wine, juices, and spirits. This is mainly important for preservative-free products.

Elevate your packaging strategy with Towards Packaging. Enhance efficiency and achieve superior results - schedule a call today: https://www.towardspackaging.com/schedule-meeting

Recent Breakthroughs in the Global Aseptic Bag-in-Box Industry

- In December 2024, Berry Global Healthcare, a contributor to innovative packaging solutions, will showcase its latest circular developments at Pharmapack 2025 in Paris. Attendees will have the opportunity to showcase Berry’s latest healthcare products, including the recently started ClariPPil jars and even bottles for OSD.

Top Companies in the Aseptic Bag-in-Box Market & Their Offerings:

- Berry Global Berry Global offers bag-in-box and bag-in-drum packaging solutions, including aseptic options for bulk transport and storage of food products like purees and concentrates.

- Mondi Group Mondi provides high-performance EVOH barrier films and other components for bag-in-box applications, focusing on product protection and extended shelf life for various liquids and semi-liquids.

- Huhtamaki Huhtamaki offers a range of flexible packaging solutions, including specialized barrier bags and spouted pouches suitable for various applications, though their specific aseptic bag-in-box offering is less prominent than their other flexible packaging options.

- Smurfit Kappa Group Smurfit Kappa is a major producer of complete bag-in-box systems, offering everything from multi-layer bags (including aseptic options) and their patented Vitop® taps to the corrugated outer boxes and filling machines.

- DS Smith Plc DS Smith, through its Rapak brand, is a supplier of bag-in-box packaging, providing the bags, taps, and fitting systems that are used in both clean and aseptic filling processes.

- Sealed Air Corporation Sealed Air (which acquired Liquibox) offers various flexible packaging solutions, including bag-in-box products for aseptic applications, which are used to maintain the sterility and quality of sensitive food and beverage products.

- Scholle IPN (part of SIG Group) Scholle IPN, now fully integrated into SIG, is a major player in bag-in-box and spouted pouch packaging, known for its aseptic filling technology and packaging solutions for both large-format (up to 1,000L) and smaller consumer-focused applications.

- Amcor Plc Amcor offers a range of flexible packaging, including solutions for bag-in-box and spouted pouches used in aseptic applications that require high barrier properties to protect sensitive products.

- SIG Group AG SIG is a leading systems and solutions provider for aseptic packaging, and following its acquisition of Scholle IPN, now offers a comprehensive portfolio including bag-in-box and spouted pouch solutions alongside its traditional carton packs.

- Tetra Pak International S.A. Tetra Pak is best known for its traditional aseptic carton packaging (Tetra Brik, etc.), which allows for shelf-stable liquid food products, and while mentioned in the general aseptic market, their primary focus is cartons rather than bag-in-box formats.

Segments Covered in the Report

By Capacity

- Up to 5 Liters

- 5–20 Liters

- 20–200 Liters

- Above 200 Liters

By Material Type

- Plastic Films

- Polyethylene (PE)

- Ethylene Vinyl Alcohol (EVOH)

- Polyamide (PA)

- Aluminum Foil

- Paperboard Laminates

- Multilayer Barrier Films

- Others

By Bag Type

- With Spout

- Without Spout

By Filling Technology

- Aseptic Filling

- Non-Aseptic Filling

By End-Use Industry

- Food & Beverage Processing

- Dairy & Juice Producers

- Wineries & Alcoholic Beverage Companies

- Pharmaceutical Manufacturers

- Industrial Chemical Companies

- Household Product Manufacturers

- Others

By Region

-

North America:

- U.S.

- Canada

- Mexico

- Rest of North America

-

South America:

- Brazil

- Argentina

- Rest of South America

-

Europe:

-

Western Europe

- Germany

- Italy

- France

- Netherlands

- Spain

- Portugal

- Belgium

- Ireland

- UK

- Iceland

- Switzerland

- Poland

- Rest of Western Europe

-

Western Europe

-

Eastern Europe

- Austria

- Russia & Belarus

- Türkiye

- Albania

- Rest of Eastern Europe

-

Asia Pacific:

- China

- Taiwan

- India

- Japan

- Australia and New Zealand,

- ASEAN Countries (Singapore, Malaysia)

- South Korea

- Rest of APAC

-

MEA:

- GCC Countries

- Saudi Arabia

- United Arab Emirates (UAE)

- Qatar

- Kuwait

- Oman

- Bahrain

- South Africa

- Egypt

- Rest of MEA

Invest in Our Premium Strategic Solution: https://www.towardspackaging.com/insights/aseptic-bag-in-box-market-sizing

Request Research Report Built Around Your Goals: sales@towardspackaging.com

About Us

Towards Packaging is a global consulting and market intelligence firm specializing in strategic research across key packaging segments including sustainable, flexible, smart, biodegradable, and recycled packaging. We empower businesses with actionable insights, trend analysis, and data-driven strategies. Our experienced consultants use advanced research methodologies to help companies of all sizes navigate market shifts, identify growth opportunities, and stay competitive in the global packaging industry.

Stay Connected with Towards Packaging:

- Find us on Social Platforms: LinkedIn | Twitter | Instagram | Threads

- Subscribe to Our Newsletter: Towards Sustainable Packaging

- Visit Towards Packaging for In-depth Market Insights: Towards Packaging

- Read Our Printed Chronicle: Packaging Web Wire

-

Get ahead of the trends – follow us for exclusive insights and industry updates:

Pinterest | Medium | Tumblr | Hashnode | Bloglovin | LinkedIn – Packaging Web Wire | Globbook | Substack | Bluesky | - Contact: APAC: +91 9356 9282 04 | Europe: +44 778 256 0738 | North America: +1 8044 4193 44

Our Trusted Data Partners

Precedence Research | Statifacts | Towards Healthcare | Towards Auto | Towards Food and Beverages | Towards Chemical and Materials | Towards Consumer Goods | Towards Dental | Towards EV Solutions | Nova One Advisor | Healthcare Webwire | Packaging Webwire | Automotive Webwire | Nutraceuticals Func Foods | Onco Quant | Sustainability Quant | Specialty Chemicals Analytics

Towards Packaging Releases Its Latest Insight - Check It Out:

- Anti-Corrosion Packaging Products Market Size, Segments, Regional Data (NA/EU/APAC/LA/MEA), Companies, Competitive Analysis

- Asia Pacific Anti-Rust Packaging Products Market Size, Segments, Companies, Competitive Analysis, Value Chain & Trade Analysis 2025-2034

- Sterilized Packaging Market Size, Segmentation, Regional Insights & Competitive Landscape Report 2025–2034

- Containerboard Market Size, Segments, Regional Data & Competitive Analysis 2025–2034

- Flexible Intermediate Bulk Container (FIBC) Market Size, Segments, Regional Data & Competitive Analysis 2025–2034

- Rigid Bulk Packaging Market Size, Segments Data, Regional Trends, Competitive Landscape, and Key Manufacturers

- Cups and Lids Market Size, Share, Trends, and Forecasts 2025-2034: Regional and Competitive Insights

- Barrier Films Packaging Market Analysis, Regional Insights, Technological Innovations and Strategic Developments (2025-2034)

- Shrink and Stretch Sleeve Labels Market Size, Segments Data, Regional Insights, Competitive Landscape, and Manufacturers Overview

- Beer Cans Market Size, Segmentation, Regional Insights, and Competitive Dynamics

- Bottle Caps Market Size, Segments Data, and Regional Insights (NA, EU, APAC, LA, MEA), Competitive Landscape, Value Chain Analysis, and Manufacturers Data

- Micro Packaging Market Size, Segments Data, Regional Insights (NA, EU, APAC, LA, MEA), Key Trends, Competitive Landscape, and Value Chain Insights

- Sustainable Foodservice Packaging Market Size, Segmentation, and Regional Insights (NA, EU, APAC, LA, MEA)

- Liquid Carton Packaging Market Size, Segmentation, and Regional Insights (NA, EU, APAC, LA, MEA)

-

Plastic Healthcare Packaging Market Size, Segmentation, Growth Insights, and Regional Analysis (NA, EU, APAC, LA, MEA)

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.